Landing your first insurance claims adjuster role can seem daunting, especially without prior experience. However, a well-crafted cover letter can significantly increase your chances of success. This guide provides a step-by-step approach to writing a compelling cover letter that highlights your strengths and demonstrates your potential, even with no direct experience. Learn how to showcase your transferable skills, tailor your letter to each job, and make a lasting impression on hiring managers. By following these guidelines, you’ll be well-equipped to make a strong first impression and take the first step towards your new career.

Highlighting Transferable Skills

Even without direct experience as an insurance claims adjuster, you likely possess a wealth of transferable skills that are highly valued in this field. These are skills you’ve gained through previous jobs, volunteer work, education, or even personal experiences. Identify and emphasize these skills in your cover letter to show how you can excel in the role. Consider your past roles, and identify where your skills overlap. For example, if you worked in customer service, highlight your skills in communication, problem-solving, and conflict resolution. These are all essential for an adjuster. If you have experience with data analysis, highlight your ability to analyze information and make informed decisions.

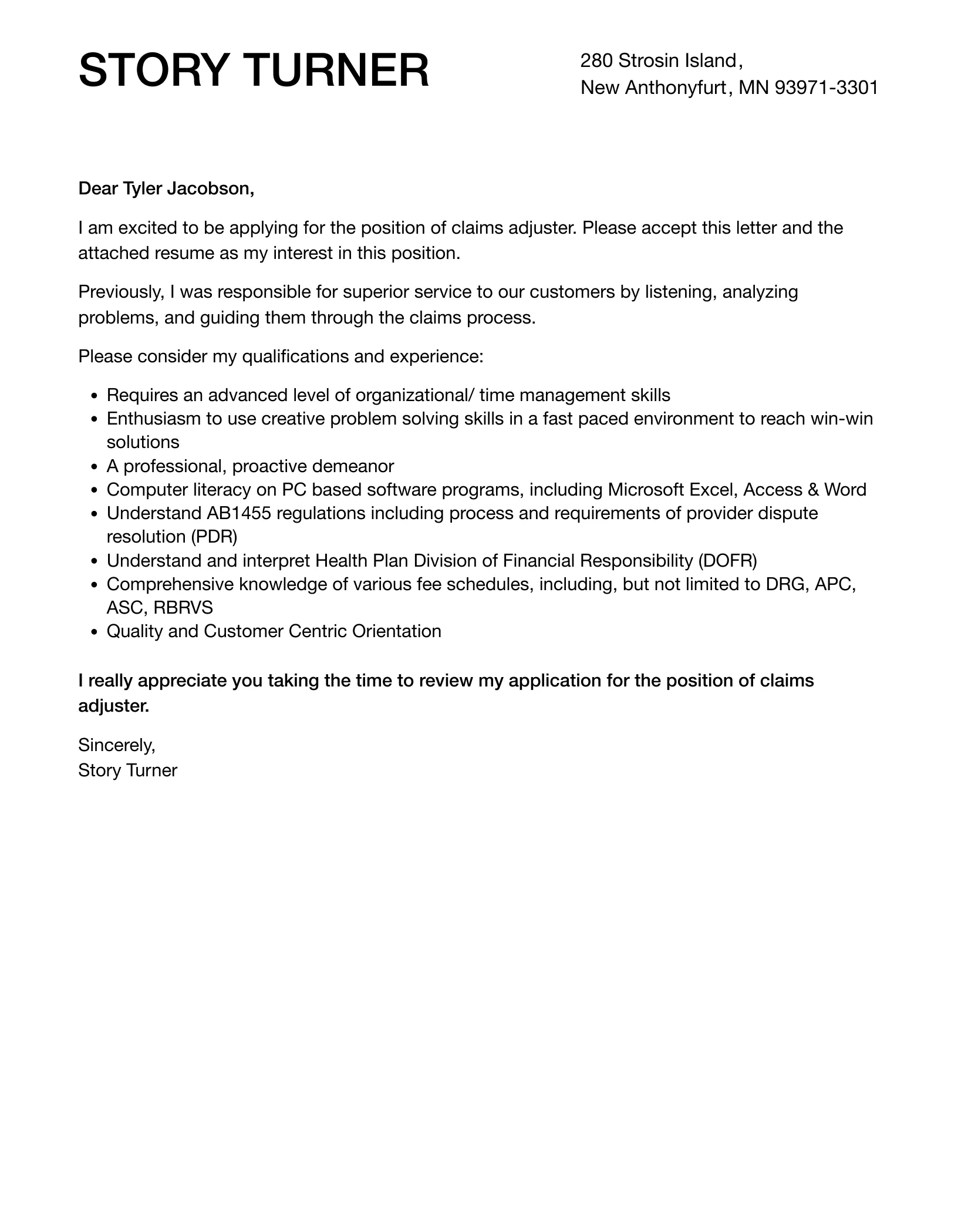

Identifying Relevant Skills

To effectively highlight transferable skills, first identify those most relevant to the claims adjuster role. Review the job description carefully to understand the specific skills and qualifications the employer seeks. Common skills include communication, analytical abilities, attention to detail, organizational skills, and customer service. Make a list of these requirements and then identify where you’ve used similar skills in your past experiences. The goal is to connect your existing skills with the demands of the adjuster position. Use keywords from the job description to tailor your cover letter, ensuring it resonates with the hiring manager.

Communication and Interpersonal Skills

Exceptional communication skills are crucial for insurance claims adjusters. They spend a lot of time interacting with people, including policyholders, witnesses, and other professionals. In your cover letter, highlight your ability to communicate clearly and effectively, both verbally and in writing. Provide examples of how you’ve handled difficult conversations, explained complex information, or resolved conflicts in previous roles. Mention instances where you had to negotiate, persuade, or build rapport with others. For example, describe how you successfully mediated a customer complaint or explained technical information to a non-technical audience.

Problem-Solving and Analytical Abilities

Claims adjusters must be adept at problem-solving and possess strong analytical abilities. They need to assess situations, gather information, analyze data, and make informed decisions. Demonstrate your capacity for critical thinking by providing examples of how you’ve solved problems in the past. Describe situations where you gathered and analyzed information to make a decision. This could be from a project in school or solving a complex issue at a previous job. Be sure to include specific details, such as how you identified the problem, the steps you took to find a solution, and the outcome. Highlight any experience with data analysis or research, even if it was part of a project or academic endeavor.

Detail-Oriented and Organized

The insurance claims process requires meticulous attention to detail and excellent organizational skills. Adjusters must manage numerous files, documents, and deadlines. In your cover letter, showcase your ability to stay organized, manage your time effectively, and pay close attention to detail. Provide examples of how you’ve maintained accurate records, managed multiple projects simultaneously, or met tight deadlines. These could be examples from academics, volunteer work or any relevant experience that showcases your abilities. If you’ve ever been responsible for maintaining a filing system, managing inventory, or organizing events, be sure to highlight this experience. The ability to work in a detailed way is key in this career.

Demonstrating Enthusiasm and Interest

It’s essential to express your genuine enthusiasm for the insurance claims adjuster role. Explain why you’re interested in the position and what attracts you to the insurance industry. Show that you’ve researched the company and understand the role. This demonstrates your initiative and commitment to the job. Avoid generic statements; instead, be specific about what excites you about the opportunity and what skills you hope to develop. Your passion for the role can make up for a lack of experience.

Researching the Company and Role

Before writing your cover letter, research the company thoroughly. Understand its mission, values, and recent accomplishments. Tailor your cover letter to show how your skills and experience align with the company’s needs. Examine the job description closely. Identify the key requirements and the skills they are looking for. Use the same language as the job description to show that you understand the role. Customize your letter to address the specific needs of the company and the position.

Tailoring the Cover Letter

A generic cover letter won’t impress a hiring manager. Customize your letter for each job application, using keywords from the job description and highlighting the skills that align with the role’s requirements. Avoid simply restating your resume; instead, expand on your skills and experiences, providing specific examples of your accomplishments. Personalize your letter to show you’ve put in the effort to understand the company and the position. If possible, mention the name of the hiring manager. Tailoring your letter shows your interest, attention to detail, and ability to understand what a company is looking for.

Emphasizing Career Goals

Clearly state your career goals in your cover letter, and explain how the insurance claims adjuster position aligns with your aspirations. Show the hiring manager that you’re committed to building a long-term career in the field. If you have specific career goals, such as becoming a senior adjuster or specializing in a certain type of claim, mention these. Showing that you have a plan for the future demonstrates your ambition and your desire to contribute to the company’s success.

Highlighting Educational Background

If you have a relevant educational background, such as a degree in business, finance, or a related field, be sure to highlight it in your cover letter. Even if your degree isn’t directly related to insurance, you can still showcase skills gained through your education. These skills could be analytical skills developed during your studies. Include any relevant coursework or projects that demonstrate skills needed for the role. Mention any certifications, licenses, or professional development courses you’ve completed. If you attended a claims adjuster course, be sure to mention it.

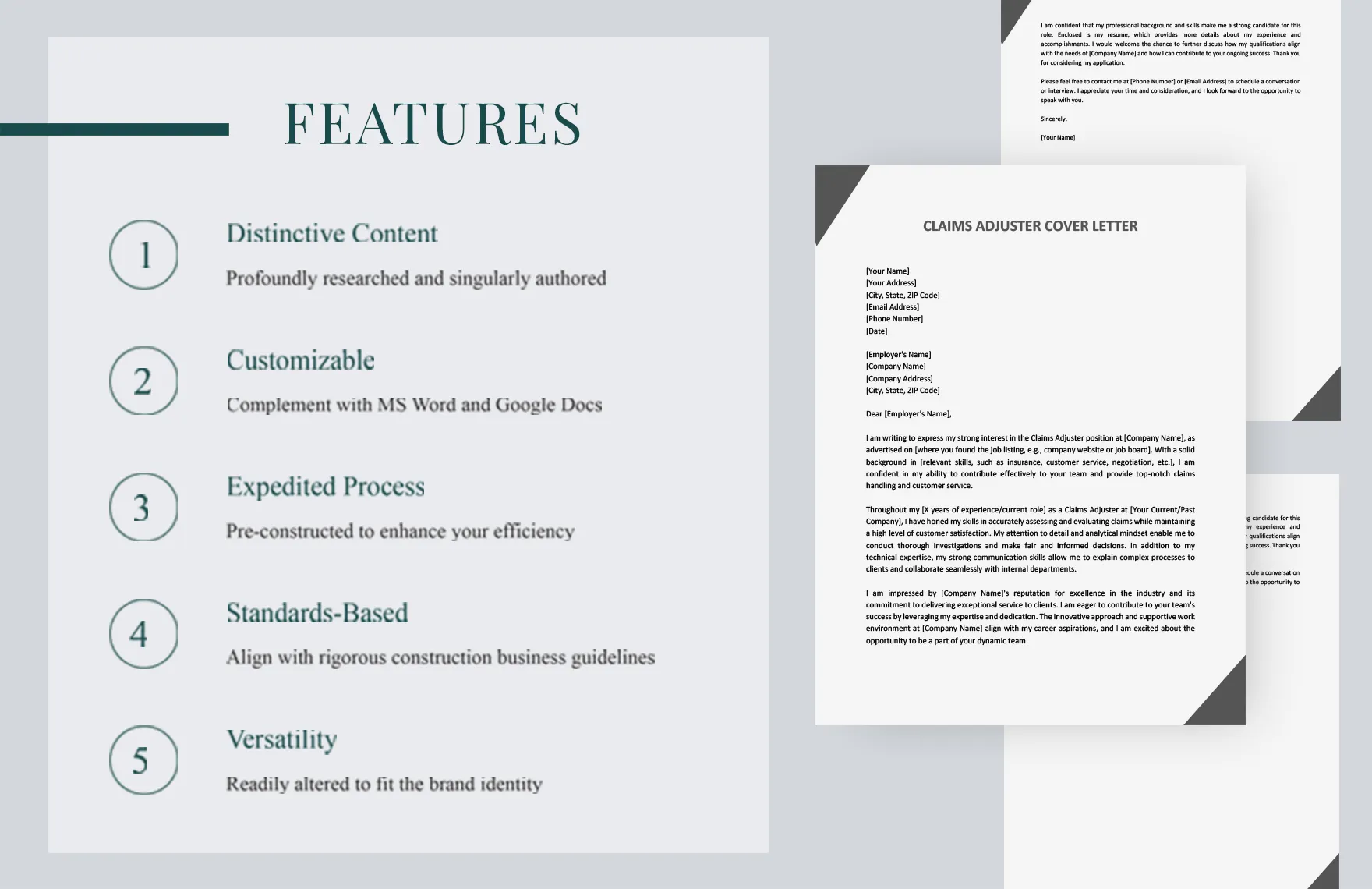

Structuring the Cover Letter

A well-structured cover letter is easy to read and effectively conveys your message. Use a clear and professional format, with a standard business letter layout. Ensure your letter is well-organized, with each paragraph focused on a specific point. Use concise language and avoid lengthy paragraphs. Your cover letter should be a compelling and well-structured document that highlights your skills and demonstrates your interest in the role.

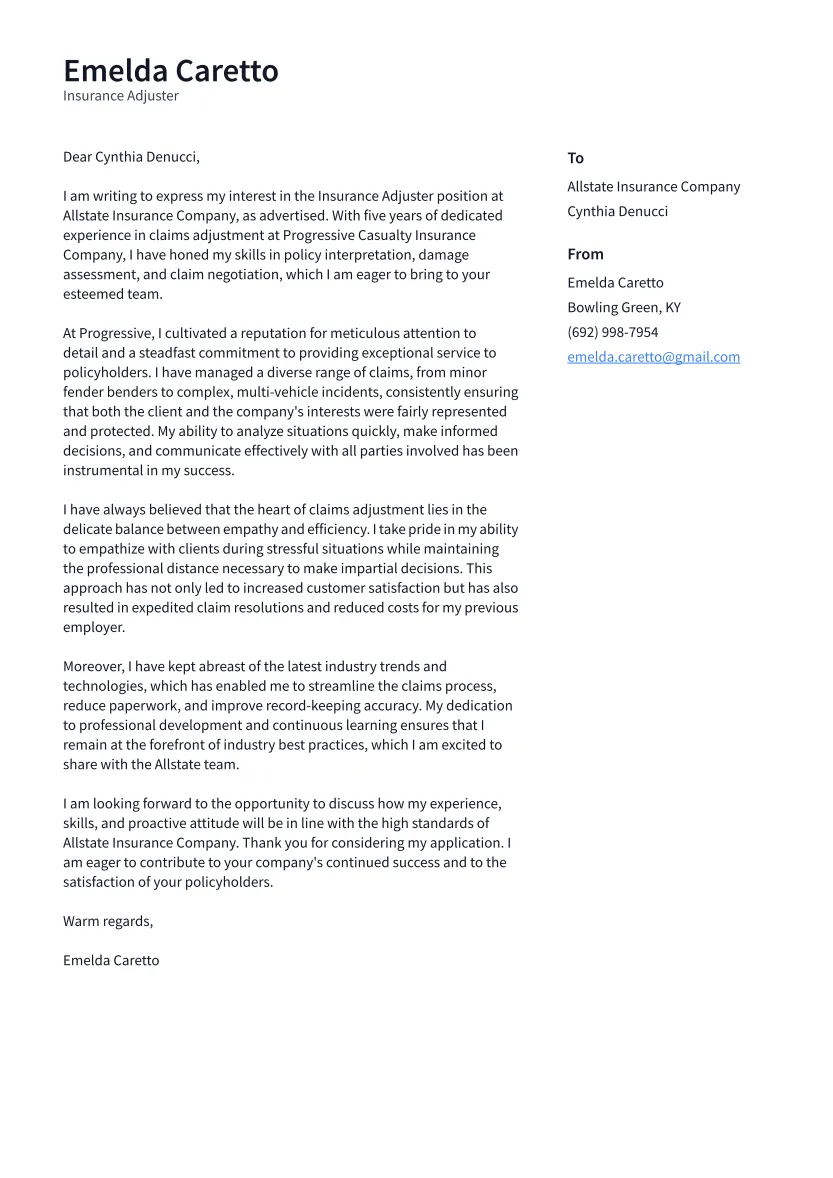

Header and Contact Information

Start your cover letter with a professional header that includes your name, address, phone number, and email address. Include the date and the hiring manager’s name and title, if known. If you’re applying through an online portal, ensure that your contact information matches the information on your resume and application. Make sure your email address is professional and appropriate for job applications.

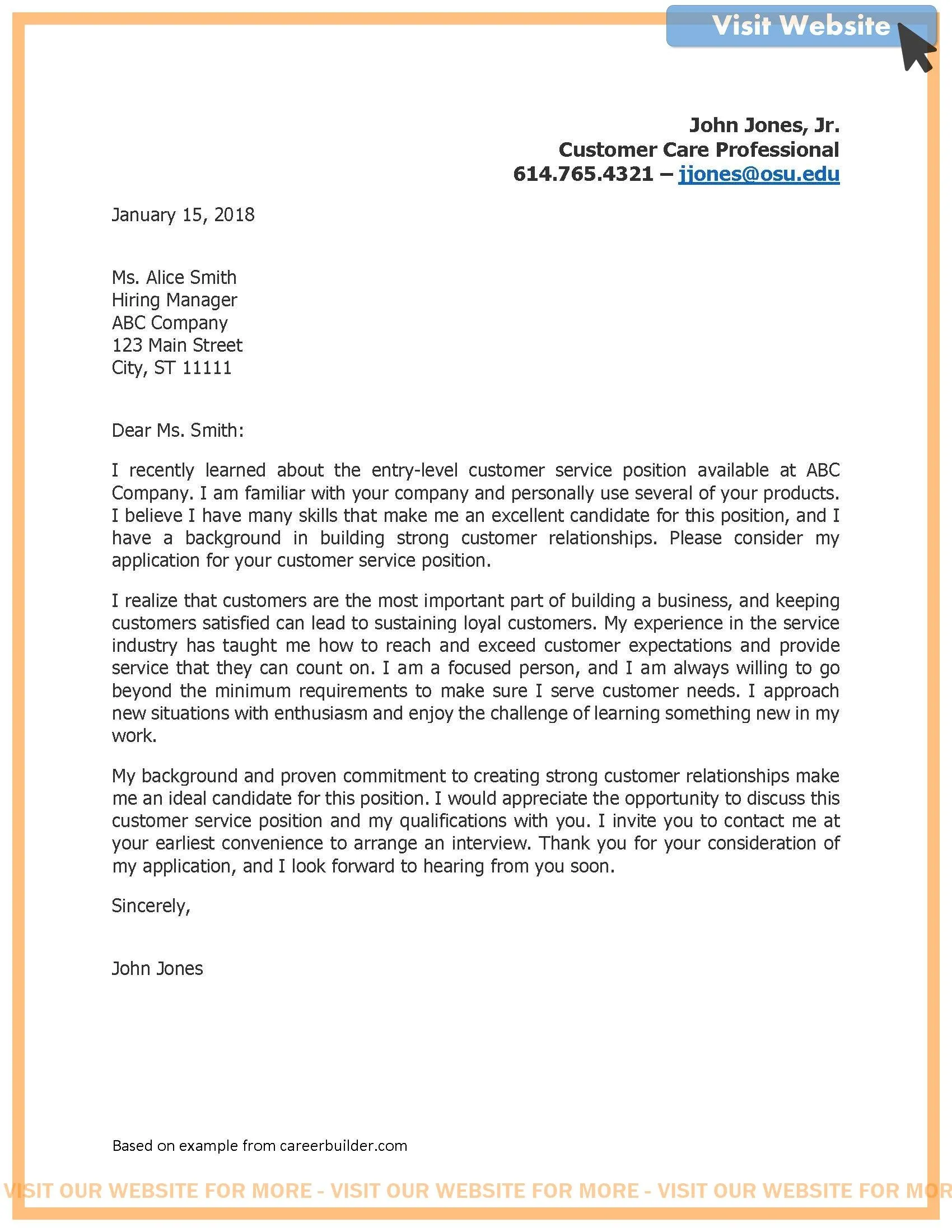

Greeting and Introduction

Address the hiring manager by name, if possible. If you’re unsure of the hiring manager’s name, use a professional greeting, such as “Dear Hiring Manager.” In the introduction, state the position you’re applying for and where you found the job posting. Briefly mention why you’re interested in the role and what makes you a strong candidate. Aim to capture the hiring manager’s attention from the start, demonstrating enthusiasm and a clear understanding of the role and the company.

Body Paragraphs

The body paragraphs are the core of your cover letter. Use these to highlight your transferable skills, provide specific examples of your accomplishments, and explain why you’re a good fit for the role. Each paragraph should focus on a different aspect of your qualifications, linking your skills and experiences to the job requirements. Use strong action verbs to describe your accomplishments, and quantify your achievements whenever possible. Emphasize the value you can bring to the company, and show the hiring manager how your skills will benefit the organization. Your goal is to show how your skills, experience, and enthusiasm can benefit the company.

Closing and Call to Action

In the closing paragraph, reiterate your interest in the position and thank the hiring manager for their time and consideration. Include a call to action, such as expressing your eagerness to discuss your qualifications further in an interview. End with a professional closing, such as “Sincerely” or “Best regards,” followed by your name. Reiterate that you are available for an interview at their earliest convenience and provide contact information.

Proofreading and Editing

Before submitting your cover letter, proofread it carefully for any errors in grammar, spelling, and punctuation. Errors can create a negative impression, no matter how strong your qualifications are. Read your cover letter aloud to catch any awkward phrasing or inconsistencies. Ask a friend, family member, or career counselor to review your letter. This will ensure your cover letter is polished, professional, and error-free.

Reviewing and Refining

Once you’ve written your cover letter, take the time to review and refine it. Ensure that your letter is tailored to the specific job and highlights your most relevant skills. Consider asking a friend or career counselor to review your letter and provide feedback. Make sure your letter is concise, well-organized, and free of errors. Revising and refining your cover letter shows you are serious about this role and ready to make a strong first impression.

Seeking Feedback

Don’t hesitate to seek feedback on your cover letter from trusted sources. Career counselors, professors, friends, and family members can offer valuable insights and suggestions for improvement. They can help you identify any areas where your letter could be stronger. If possible, ask someone familiar with the insurance industry to review your letter. This external perspective can help you identify weaknesses or areas that need clarification. Make sure to incorporate the feedback and make any necessary revisions.

Writing a compelling cover letter as an insurance claims adjuster without experience is possible by highlighting your transferable skills, demonstrating your enthusiasm, and tailoring your letter to each job. By following the steps outlined in this guide, you can create a cover letter that showcases your potential and increases your chances of landing an interview and taking the first step towards your new career. Remember to be professional, enthusiastic, and show that you are eager to begin your new career.